irs federal income tax brackets 2022

RATEucator - Income Brackets Rates. IRSgov English IRSgovSpanish Español.

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest

Its important to remember that moving up into a higher tax bracket does not mean that all of your income will be taxed at the.

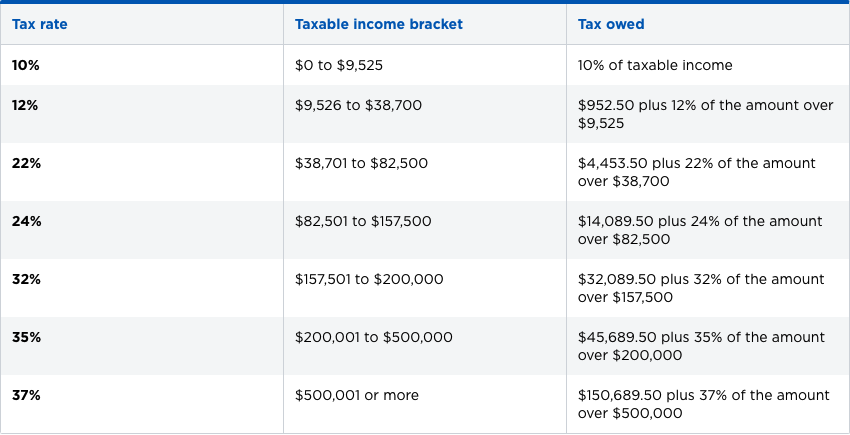

. There are seven federal tax brackets for the 2021 tax year. Do you want to know what is federal tax rate on retirement income. The IRS released the federal marginal tax rates and income brackets for 2022 on Wednesday.

15 Tax Calculators 15 Tax Calculators. See chart at left. Tax planning and taxable income.

W-4R are available for use in 2022 the IRS is postponing the requirement to begin using the forms until January 1 2023. 2017 Federal Income Tax Forms. Federal Income Tax Withholding Methods For use in 2022 Get forms and other information faster and easier at.

Payers should update their system programming for. Maines maximum marginal income tax rate is the 1st highest in the United States ranking directly. 10 12 22 24 32 35 and 37.

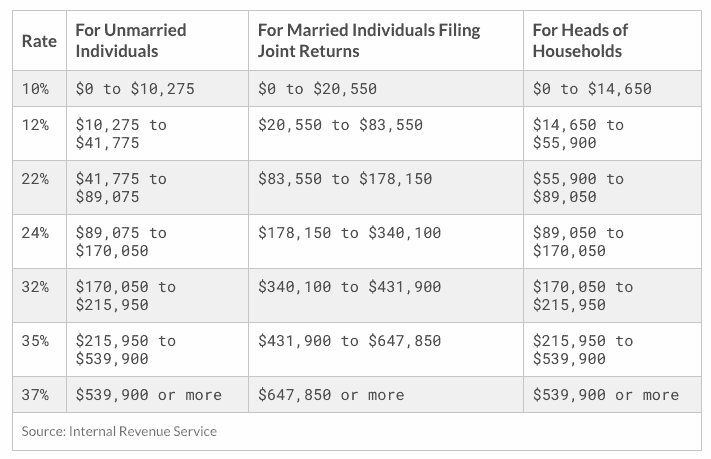

The IRS recently released the new inflation adjusted 2022 tax brackets and rates. Imposes tax on income using by graduated tax rates which increase as your income increases. And the standard deduction is increasing to 25900 for married couples filing together and 12950 for.

If you are looking for 2020 tax rates you can find them HERE. The additional 38 percent is still applicable making the maximum federal income tax rate 408 percent. The forms below can be opened in an online editor.

Explore updated credits deductions and exemptions including the standard deduction personal exemption Alternative Minimum Tax AMT Earned Income Tax Credit EITC Child Tax Credit CTC capital gains brackets qualified business income deduction 199A and the annual. PAYucator - Paycheck W-4 Calculator. What this Means for You.

These are the federal income tax brackets for 2021 and 2022. South Carolina Tax Brackets 2022 - 2023. Like the Federal Income Tax Maines income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers.

2021-2022 federal income tax brackets rates for taxes due April 15 2022. Youve come to the right place. See Tax Forms for other Tax Years and review Tax Planning Tips for future years that help you balance your taxes.

The highest income tax rate was lowered to 37 percent for tax years beginning in 2018. The personal exemption for tax year 2022 remains at 0 as it was for 2021 this elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act. For tax year 2022 the top tax rate remains 37 for individual single taxpayers with incomes greater than 539900 647850 for married couples filing jointly.

This history is important because it shows that the tax law is always changing. But as a percentage of your income your tax rate is generally less than that. The tax rates for 2020 are.

Instead of any increase in real income. Learn about our editorial policies. 10 12 22 24 32 35 and 37.

10 12 22 24 32 35 and 37. Your tax bracket is the rate you pay on the last dollar you earn. Lets take the example of the 2017 tax brackets.

The state mailing address is on the state income tax form. The federal tax brackets are broken down into seven 7 taxable income groups based on your filing status. Our mission is to protect the rights of individuals and businesses to get the best possible tax resolution with the IRS.

West Virginia Tax Brackets 2022 - 2023. Your tax bracket depends on your taxable income and your filing status. If youre trying to determine your marginal tax rate or your highest federal tax bracket youll need to know two.

Personal income tax rates begin at 10 for the tax year 2021the return due in 2022then gradually increase to 12 22 24 32 and 35 before reaching a top rate of 37. Access Complete Sign and Mail 2016 Federal Income Tax Forms. We can also see the progressive nature of South Carolina state income tax rates from the lowest SC tax rate.

Updated May 27 2022. The federal tax brackets are broken down into seven 7 taxable income groups based on your filing statusThe tax rates for 2021 are. He previously worked for the IRS and holds an enrolled agent certification.

Pinterest Facebook Instagram Youtube Twitter. Maine collects a state income tax at a maximum marginal tax rate of spread across tax brackets. 2020 Individual Income Tax Brackets.

Your bracket depends on your taxable income and filing status. The basics on federal income tax rates. 2021 Tax Year Return Calculator in 2022.

Federal income tax rates are divided into seven segments commonly known as income tax brackets. We can also see the progressive nature of West Virginia state income tax rates from the lowest WV tax rate bracket. There are seven tax brackets for most ordinary income for the 2021 tax year.

All taxpayers pay increasing income tax rates as their income rises through these segments. Tax Changes for 2021 - 2022 - 2020 rates have been extended for everyone. First here are the tax rates and the income ranges where they apply.

These tax rates are the same for 2022 but they apply to different income levels than in 2021. Explore 2021 tax brackets and tax rates for 2021 tax filing season. The IRS has announced higher federal income tax brackets for 2022 amid rising inflation.

2021 Individual Income Tax Brackets. Looking at the tax rate and tax brackets shown in the tables above for South Carolina we can see that South Carolina collects individual income taxes similarly for Single versus Married filing statuses for example. The IRS used to use the Consumer Price Index CPI as a.

W-4 Pro Select Tax Year 2022. See IRS Tax Return Mailing Addresses based on the state you reside. The seven tax rates remain unchanged while.

Looking at the tax rate and tax brackets shown in the tables above for West Virginia we can see that West Virginia collects individual income taxes similarly for Single versus Married filing statuses for example.

Federal Personal Income Tax Rates Schedule 1 Haefele Flanagan

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Federal Income Tax Brackets Brilliant Tax

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Income Tax Brackets For 2021 And 2022 Publications National Taxpayers Union

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

2022 Tax Inflation Adjustments Released By Irs

New 2021 Irs Income Tax Brackets And Phaseouts

Federal Income Tax Brackets Brilliant Tax

2022 Trucker Per Diem Rates Tax Brackets Per Diem Plus

Irs 2022 Tax Tables Deductions Exemptions Purposeful Finance

How The Tcja Tax Law Affects Your Personal Finances

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks